Problem 11-4 maintaining the checkbook – Problem 11-4: Maintaining the Checkbook introduces fundamental concepts and techniques for managing checkbook records effectively. Understanding checkbook maintenance is crucial for individuals and businesses to maintain accurate financial records, minimize errors, and ensure sound financial decision-making.

This comprehensive guide delves into the significance of checkbook maintenance, common errors to avoid, and various methods for keeping checkbooks up-to-date. It also explores the benefits of using technology for checkbook management and advanced techniques for budgeting and financial planning.

1. Understanding Checkbook Maintenance

Maintaining a checkbook is crucial for managing finances effectively. It allows individuals and businesses to track their income, expenses, and account balances, providing a clear picture of their financial status. Organizing checkbook records is essential to ensure accuracy and timely reconciliation.

Regular reconciliation of checkbook balances is vital to identify any discrepancies between the bank statement and the checkbook register. This process helps prevent errors, detect fraud, and ensure the accuracy of financial records.

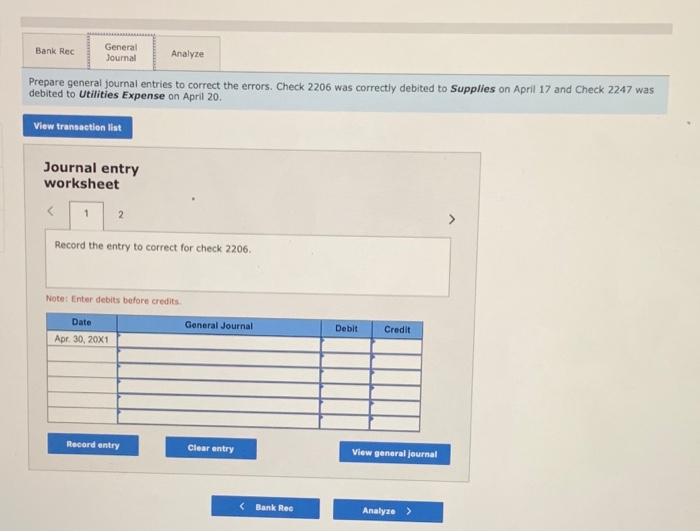

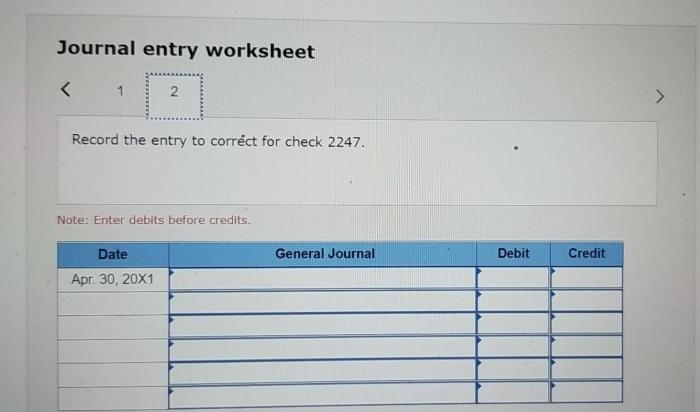

2. Common Errors in Checkbook Maintenance: Problem 11-4 Maintaining The Checkbook

Common errors in checkbook maintenance include:

- Incorrect recording of transactions

- Omitting transactions

- Mistakes in calculations

- Lost or misplaced checks

- Insufficient attention to reconciliation

These errors can lead to inaccurate checkbook balances, making it difficult to manage finances effectively.

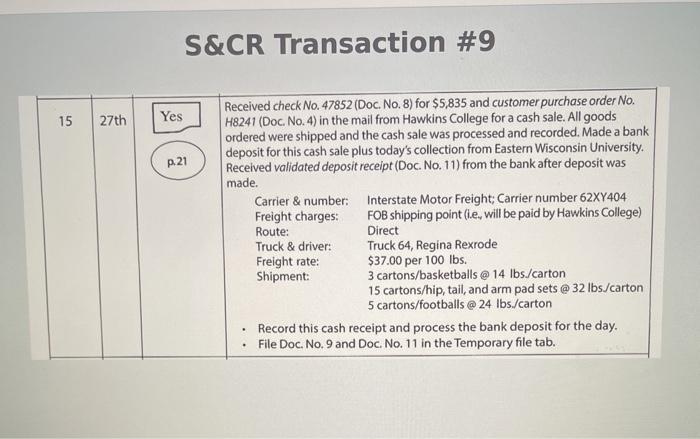

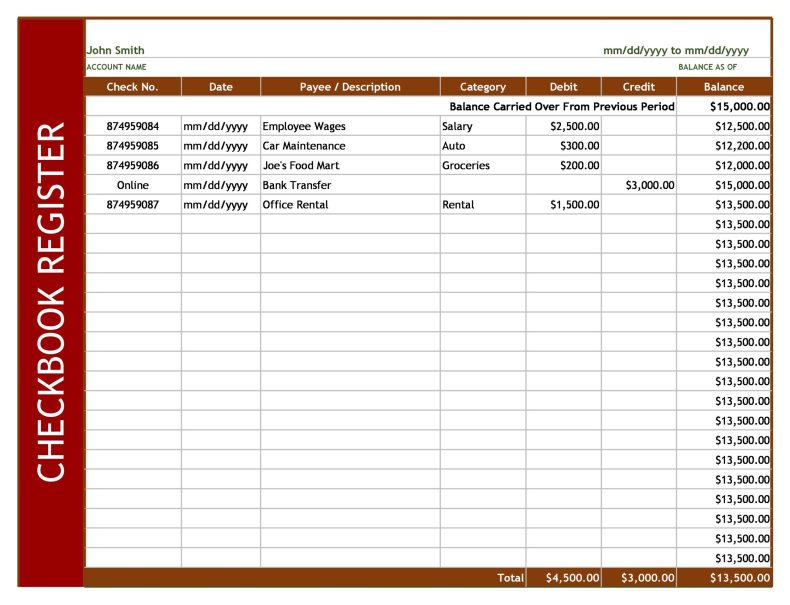

3. Methods for Maintaining a Checkbook

There are several methods for maintaining a checkbook:

Manual Method

This method involves using a physical checkbook register to record transactions.

Checkbook Register

A checkbook register is a book or software that allows users to record checkbook transactions and reconcile balances.

Online Checkbook Management

This method involves using online banking or mobile apps to manage checkbook transactions.

4. Reconciling Checkbook Balances

Reconciling checkbook balances involves the following steps:

- Gather bank statement and checkbook register.

- Compare check numbers and amounts.

- Identify outstanding checks.

- Account for deposits and withdrawals.

- Calculate adjusted balance.

Regular reconciliation ensures accuracy and prevents errors.

5. Using Technology to Maintain Checkbooks

Various mobile apps and software are available for checkbook management:

- Mobile banking apps

- Checkbook register apps

- Online banking platforms

These tools simplify checkbook maintenance and provide features like transaction tracking, budgeting, and fraud alerts.

6. Advanced Checkbook Management Techniques

Advanced checkbook management techniques include:

Checkbook Budgeting, Problem 11-4 maintaining the checkbook

Using a checkbook to track expenses and create a budget.

Expense Tracking

Using a checkbook to monitor spending patterns and identify areas for improvement.

Financial Planning

Using a checkbook to plan for future financial goals.

FAQ Corner

What is the primary purpose of maintaining a checkbook?

Maintaining a checkbook allows individuals and businesses to keep an accurate record of their financial transactions, track their cash flow, and monitor their financial position.

What are some common errors that can occur in checkbook maintenance?

Common errors include recording incorrect amounts, failing to record transactions, and making mathematical errors during reconciliation.

What is the importance of reconciling checkbook balances regularly?

Regular reconciliation helps identify errors, ensures the accuracy of checkbook records, and provides an overview of the actual financial position.